Best Invoice Software for Small Businesses Wave Financial

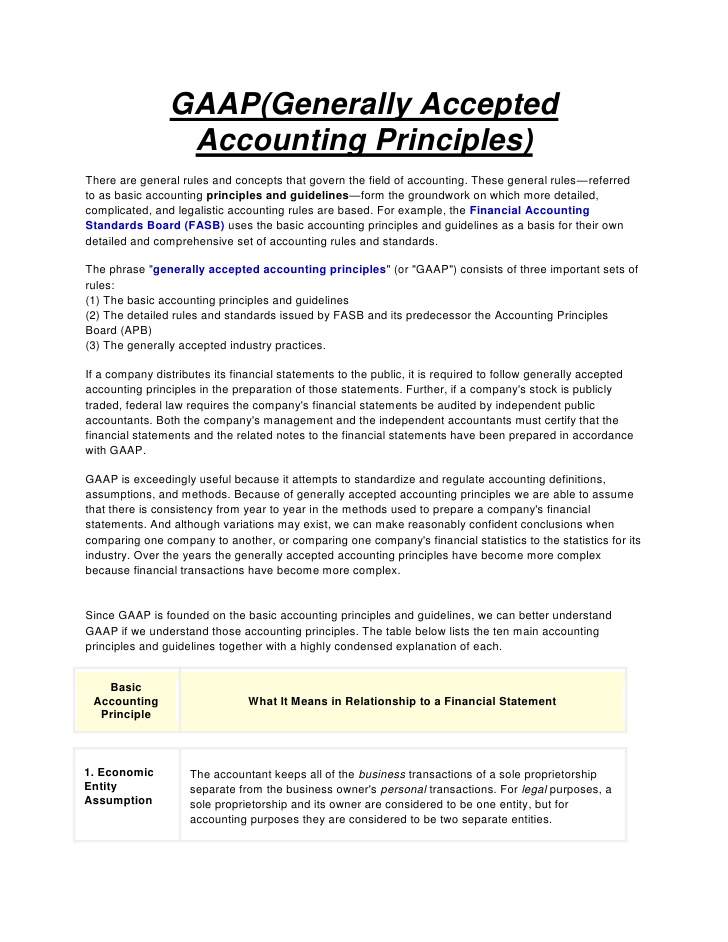

Easily create, customize, and send professional invoices while on-the-go. The rate that you charge for your freelancing services can vary, so it’s important to get a grasp of market trends before sending your clients an invoice or quoting a price. Freelance rates can differ depending on experience level https://www.online-accounting.net/ and industry. For example, the rate a freelance web developer charges may be different than that of a freelance graphic designer, because each freelancer specializes in a different area. The Wave app lets you easily generate and send invoices to your clients wherever and whenever you need to.

Pocket- and small business-friendly perks

We built our payroll tool for small business owners, so it’s easy to use AND teaches you as you go. Give your customers the option of paying with one click using a credit card, bank transfer, or Apple Pay. Create beautiful, free invoices that reflect your business branding. Automate overdue reminders, set up recurring bills, and add notes or terms of service with ease. Last year, the U.S. recorded its most heat waves — abnormally hot weather lasting more than two days — since 1936.

Manage accounts receivable effortlessly

Wave has helped over 2 million North American small business owners take control of their finances. Wave has helped over 2 million small business owners in the US and Canada take control of their finances. The developer does not collect any data from this app. “Those without access to reliable air conditioning are urged to find a way to cool down,” the service said in its forecast. With this release, we’re waving bye to bugs and hello to stability improvements. Thanks for using Wave to help you stay more in control of your business while on-the-go.

Accounting made easy.

- Say #sorrynotsorry to your spreadsheets and shoeboxes.

- Get paid in as fast as 1-2 business days1, enhance your brand, and look more professional when you enable Payments.Accept credit cards, bank payments, and Apple Pay for as little as 1%2 per transaction.

- Import, merge, and categorize your bank transactions.

- Email invoices with a secure “Pay Now” button after you’ve enabled the online payments option.

Approval is subject to eligibility criteria, including identity verification and credit review. Payments are a https://www.accountingcoaching.online/the-difference-between-a-stockholder-and-a/ pay-per-use feature; no monthly fees here! Your deposit times may vary based on your financial institution.

See all Payments features

When I signed up with Wave it was a no brainer. It’s been one of the best decisions I’ve made when it comes to making sure my accounting is on point. Our (non-judgmental) team of bookkeeping, accounting, and payroll experts is standing by to coach you—or do the work for you.

Look professional with customizable invoices

NWS forecast warns of prolonged dangerously hot conditions, including high humidity that may cause heat illness. The first significant heat wave of the summer already has «extreme» heat advisories forecast throughout the tri-state area. The developer, College Health Services, indicated that the app’s privacy practices may include handling of data as described below. For more information, see the developer’s privacy policy. (AP) — As New England baked in a heat wave Thursday, guests at one campground were keeping their food and beer cold with blocks of ice harvested months earlier from a frozen lake.

Create beautiful invoices, accept online payments, and make accounting easy—all in one place. Bank data connections are read-only and use 256-bit encryption. Servers are housed under physical and electronic protection. Wave is PCI Level-1 certified for handling credit card and bank account information. Have an eye on the big picture so you can make better business decisions.

You can accept credit cards and bank payments for as little as 1%2 per transaction. Electronic invoices are created with online invoicing software or other cloud-based services, which makes it easy to automate the invoicing process. Electronic invoices also provide small business owners with professional-looking digital invoices that their customers can pay easily online through a system like Wave’s online payments. Get what is the debt ratio paid in as fast as 1-2 business days1, enhance your brand, and look more professional when you enable Payments.Accept credit cards, bank payments, and Apple Pay for as little as 1%2 per transaction. Create beautiful invoices, accept online payments, and make accounting easy—all in one place—with Wave’s suite of money management tools. You can mark invoices paid on the spot, so your records are instantly up to date.

Wave’s accounting software is built for small business owners. Be your own accountant, thanks to Wave’s automated features, low cost, and simple interface. Have an eye on the big picture so you can make better decisions. Our accounting reports are easy to use and show monthly or yearly comparisons, so you can easily identify cash flow trends.

You can effectively analyze the financial health of your business, find ways to generate more profit, and move forward with your business plan. With Wave’s Pro Plan, you can set up recurring invoices and automatic credit card payments for your repeat customers. Switch between automatic and manual billing whenever you want.

Automate the most tedious parts of bookkeeping and get more time for what you love. Ready to invoice in style, bookkeep less, and get paid fast?

Connect your bank accounts in seconds with the Pro Plan. Transactions will appear in your bookkeeping automatically, and you’ll say goodbye to manual receipt entry. Transactions will appear in your books automatically, and you can say goodbye to manual receipt entry. A common issue when invoicing in Microsoft Word, Excel, or other DIY solutions is making calculation errors. Wave’s invoicing software for small businesses removes the worry of making these errors because calculations are done for you, including the taxes. You’ll receive the money in your account in 1 business day (Canada), or 2 business days (US)1.