Best Online Cryptocurrency Brokers in June 2024

Once you’ve signed up with a crypto brokerage, you’ll need to connect your bank account. Most crypto brokerages offer bank funding through debit cards and wire transfers. ACH deposit (linked bank account transfer) is typically your cheapest option to fund your account, and it’s free on most platforms. Cryptocurrencies best cryptocurrency brokers are various forms of digital money that are usually based on blockchain technology. Blockchain technology allows most cryptocurrencies to exist as “trustless” forms of transactions. This means there is no centralized authority overseeing the transactions on a cryptocurrency’s blockchain.

Best for Underlying Crypto Assets

That’s because bitcoin represents more than 45% of the total cryptocurrency market. So when we talk about any cryptos outside of bitcoin, all of those cryptos are considered altcoins. If you buy and sell coins, it’s important to pay attention to cryptocurrency tax rules. As a cryptocurrency trader, you should understand the difference between various types of accounts. A swap/rollover fee is charged when you hold a leveraged position overnight. Traders should pay extra attention to these fees if they plan to use swing trading strategies, which involve holding positions for several days or even weeks.

Make your money work for you

Exness has been in business since 2008, offering trading in forex, crypto, stocks, indices, metals, and commodities. The broker provides access to 35 cryptocurrencies, including https://forexbroker-listing.com/ Bitcoin, Litecoin, and Ripple. When it comes to platform staking fees and interest, make sure you understand and are comfortable with how the interest is generated.

Trading Fees

In addition to its wide range of tradable assets, Interactive Brokers stands out for its advanced trading platform, targeting experienced and professional traders. One of the oldest cryptocurrency exchanges, and in business since 2013, Kraken’s low fees make it particularly attractive to high-volume traders. Kraken also offers riskier and more advanced trading features — such as margin trading and on-chain staking, with biweekly payouts. Increasingly, traders have more and more ways to access cryptocurrencies. New exchanges and trading platforms have started in response to the wide interest in crypto. For example, if you have the PayPal or Venmo apps, you can buy and sell at least a few different cryptocurrency coins.

Centralized Exchanges

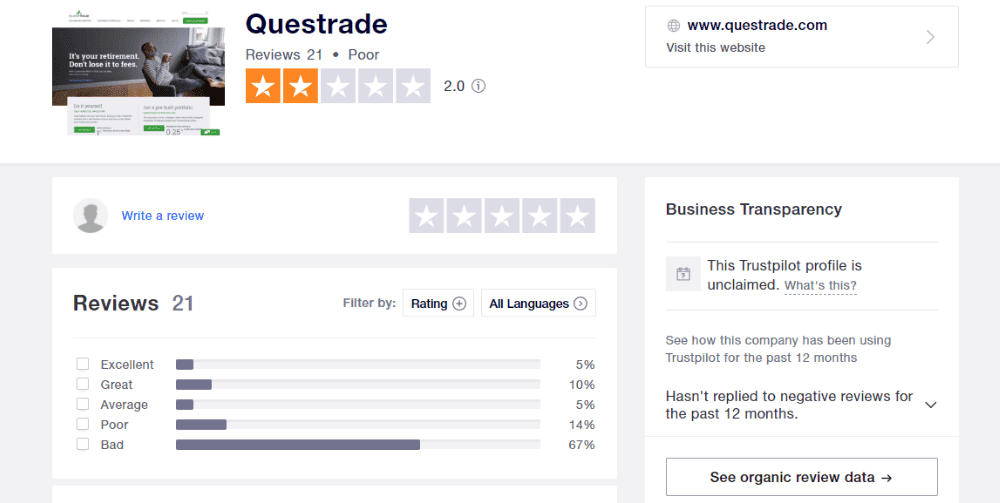

FX Empire has been reviewing brokers since 2010 and has developed an in-depth review program of CFD brokers. We have more than a decade of experience testing brokers and abide by strict guidelines for editorial integrity. Our review process follows a thorough protocol that results in a score that is based on objective criteria and measurable data. As a result of our work, we publish a comprehensive and unbiased review, which is meant to help traders choose the broker that suits their needs. Trading crypto with a CFD broker allows traders to speculate on the price of an asset, such as a cryptocurrency, without actually owning the underlying asset. This means that traders can make a profit or loss based on the price movement (up or down) of the asset without having to buy or sell the actual cryptocurrency.

The best crypto broker for you will depend on your trading style, preferences and level of experience. Take the time to research and compare different brokers to find the one that best suits your financial needs. A crypto exchange is a marketplace where you can buy and sell cryptocurrencies, like bitcoin, Ether or Dogecoin. Cryptocurrency exchanges work a lot like other trading platforms that you may be familiar with. They provide you with accounts where you can create different order types to buy, sell and speculate in the crypto market. The eToro USA crypto exchange offers a highly secure and easily navigable interface that gives you access to over 20 crypto assets.

Best Crypto Trading Platform

The major sectors include information technology, consumer discretionary and communication services. Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.

Crypto brokers provide an easily accessible and familiar avenue for trading cryptocurrencies. Alternatively, you could also trade cryptocurrencies on centralized or decentralized crypto exchanges. Fidelity stands out among other brokerage platforms that support crypto trading by offering a wide selection of crypto ETFs, from recently launched spot Bitcoin ETFs to a Metaverse ETF and more. For investors primarily interested in digital asset ETFs, Fidelity is the best option. Founded in 1943 and headquartered in Boston, Fidelity is one of the largest financial services companies in the world and offers one of the most popular online brokerage platforms in the U.S. The online brokerage platform offers a wide range of asset classes and investment products, enabling its customers to manage most, if not all, of their investment needs on one platform.

- While the individual on the trading desk is helping to “broker” each trade, it’s important to note that they will almost always utilize underlying crypto exchanges to execute their trades.

- The exchange boasts a modern and intuitive interface that is a treat to use.

- Today, Bitcoin and Ether futures, as well as micro futures and options are available, allowing businesses and individuals to mitigate the risk of rapid changes in cryptocurrency prices.

- The platforms below include specialized crypto exchanges, online brokers, and cash and payment apps.

NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

Crypto.com provides a very good selection of cryptocurrencies, with more than 250 available. The platform offers unique perks and crypto rewards for Crypto.com Visa Card users. Crypto.com offers a massive selection of digital assets, low or no fees, and additional perks for holders of its CRO cryptocurrency. Robinhood brings its no-fee ethos to cryptocurrency trading, but currently offers fewer cryptocurrencies compared to pure-play crypto platforms. The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Capital gains occur when a person sells their cryptocurrency for dollars or another cryptocurrency and makes a profit. You do not need to buy a whole Bitcoin or any cryptocurrency; you may make fractional purchases. EToro USA LLC; Investments are subject to market risk, including the possible loss of principal.

15.09% don’t believe that crypto exchanges should be regulated to the same degree. However, because of the FTX collapse, more than half of our panelists (58.49%) believe that crypto exchanges should be regulated just as much as other financial trading platforms. The best crypto exchanges enable you to trade coins and tokens easily while keeping your assets safe and your fees low.

Learn about how to protect yourself by reading our guide to avoiding crypto scams. The fees to trade bitcoin generally start at anywhere from 0.002% to as much as 2% (and sometimes even more) of the trade value, depending on where you trade and the trade size. Furthermore, bitcoin is highly resistant to any form of censorship, and forged transactions are impossible, thanks to the cryptographic primitives used in the bitcoin blockchain (and in bitcoin wallets). CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74% and 89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.